News & Insights

“America’s largest public pension scheme, Calpers, which manages some $444 billion in capital on behalf of California’s 1.5 million state, school, and public agency employees, is leaning into venture—even as many LPs lean away. ”

12 JUNE 2023

“As more European start-ups reach billion-dollar valuations, start-up groups are urging the EU to introduce policy reforms that will ramp up the number of so-called unicorns…”

10 MAY 2021

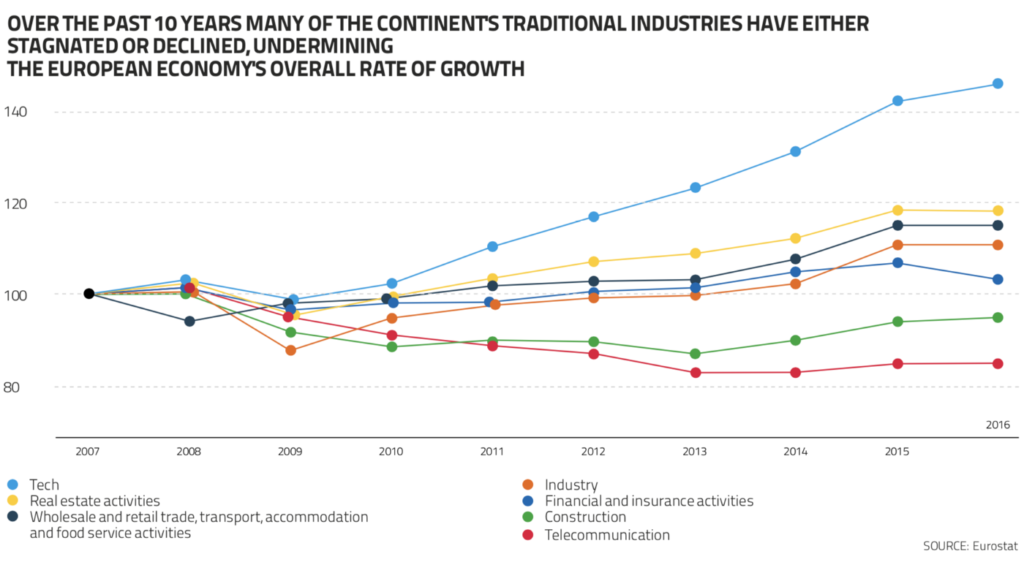

“Frank Thelen, the investor and TV celebrity famous for his appearances on Die Höhle der Löwen, Germany’s version of Shark Tank, is on a mission to create a strong European technology sector.

Part of that, he says, is getting the message out that rich European need to stop investing in the kind of boring conventional assets that families have been investing in for hundreds of years and think about tech instead.”

13 JANUARY 2021

Dealroom’s analysis found that a Seed-funded company building from Europe has the same probability of scaling to a $1B+ valuation as the average Seed-funded company building from the US. According to the funnel analysis, 13 of the 1,064 companies in the starting cohort have gone on to achieve a $1B+ valuation, equivalent to 1.2%. In other words, a company raising a Seed round of funding in Europe has about a 1-in-a-100 shot of becoming a unicorn.

The State of European Tech 2020

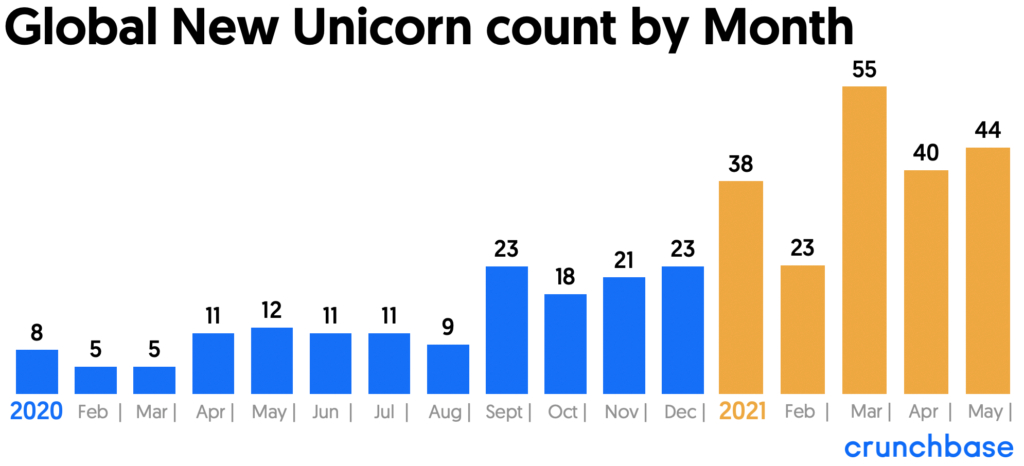

The current Crunchbase Private Unicorn Board hosts more than 820 companies collectively valued at $2.8 trillion that have raised a total of $560 billion over time.

The fastest companies to become unicorns in 2021 were Chinese semiconductor company Moore Threads, Germany-based delivery company Gorillas, audio app Clubhouse, and proptech company Pacaso, both based in San Francisco, as well as Israel-based cybersecurity firm Wiz.

The three leading sectors for these new unicorns are financial services, health care, and privacy and security.

17 MAY 2021

Over 80% of later stage tech venture capital in Britain comes from overseas investors but it’s a Europe-wide problem, says top British VC

British scale-ups suffer from the lack of deep-pocketed investors willing to back later, bigger funding rounds. Typically, these Series D or Series E funding rounds are the penultimate stage before going public

This means that either fast-growing scale-ups relocate, typically to America, where they float on the New York Stock Exchange. This robs British pension funds of the chance to invest in fast-growth hi-tech businesses, which the government wants to encourage.

It’s not just a British problem, says Chandratillake, it’s endemic across the Continent, both in the other tech hubs of Paris and Berlin.

18 MARCH 2021

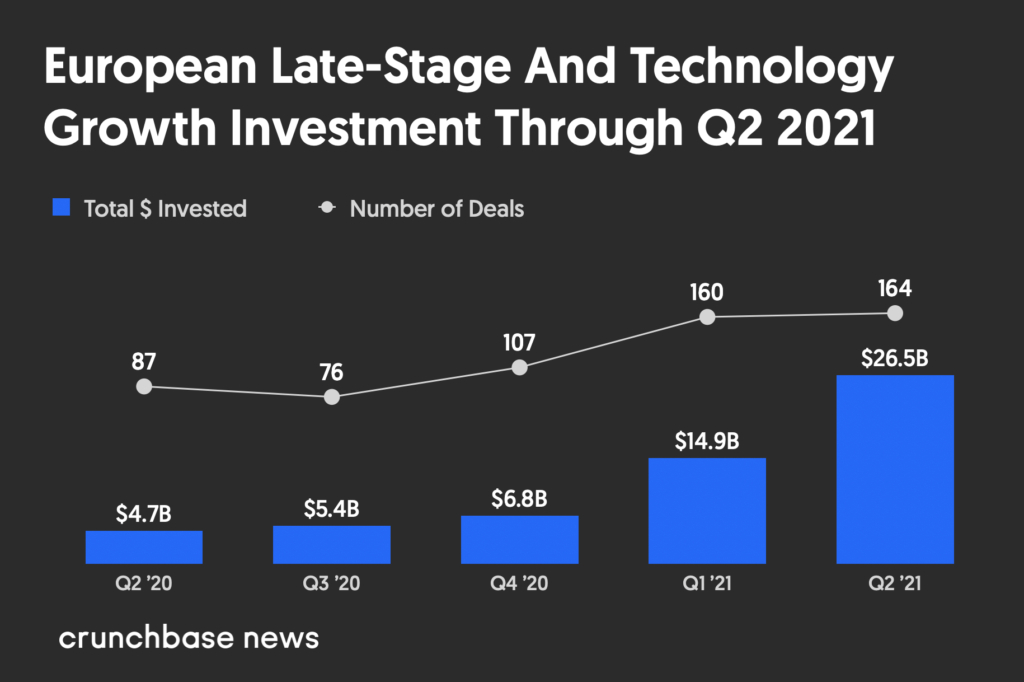

One of the Continent’s biggest handicaps has been the inability of its startups to scale thanks to a lack of growth funding. The good news is Europe now has a swelling group of unicorns, companies with valuations of $1 billion or more. Expect that number to rise.

But the lack of late stage capital from European sources means that even when high-growth companies stay here the value flows elsewhere.

Over the last five years, pension funds have invested just $1.7 billion in European venture capital, but have invested 45 times more in European buyout funds, equivalent to more than $75 billion over that period, notes a December 2018 report by European venture capital firm Atomico.

« We need to work to get European private money into the ecosystem to foster entrepreneurship, » says German serial entrepreneur Felix Staeritz, a board member of the Forum’s Digital Leaders of Europe and Digital Platforms & Ecosystems working groups and a Founding Partner of Factor10, an independent corporate company builder.« We are building unicorns in Europe but we don’t provide them with enough growth capital and then they have to raise money from Asia and the U.S. to keep on growing, which is totally ridiculous, » he says. It is time to change regulations in Europe which limit pension funds from investing more than a small percentage in risk capital, says Staeritz. The same constraints do not exist in the U.S. « The total share of how much money can be invested into risk capital is way higher in the U.S.– they have so much more growth capital, » says Staeritz.

Leveraging more private funding here would have multiple benefits, says the Atomico report. “If pension funds rebalance their allocations away from legacy industries towards game-changing technology instead, they can democratize access to the spoils of European tech.”

25 JULY 2019

…with 44 new unicorns this past month, or on average more than two per working day. These include the U.S.-based healthy eating app Noom, vocation video company MasterClass, and college recruiting service Handshake. Commission-free broker Trade Republic from Germany, cryptocurrency exchange platform Bitso from Mexico, and online customer behavior tracker Contentsquare from France also joined the unicorn ranks in May 2021.

Tiger Global Management, Accel, Softbank Vision Fund, Sequoia Capital, Fidelity Management and Coatue have the highest portfolio count in these new unicorns, each with six to seven portfolio companies in this new batch.

9 JUNE 2021

Late-stage funding in the second quarter of 2021 is up by a massive 466 percent year over year. Europe’s late-stage funding is half the size of late-stage funding invested in North American companies in the second quarter.

Lithium ion battery company Northvolt, headquartered in Sweden, raised a $2.7 billion funding last quarter. Execution management company Celonis, headquartered in Munich, raised a billion-dollar funding round. Berlin-based Trade Republic, a commission-free broker, raised a $900 million Series C. And cloud communications company MessageBird from Amsterdam raised an $800 million Series C.

“It’s an excellent time to be an entrepreneur. The abundance of capital is pushing early stage funding rounds to increase in size, sometimes skipping what used to be seed; and we are also seeing a proliferation of stage agnostic funds, both European and U.S.-based, actively prioritising the region,” Luca Bocchio, a partner at Accel, told Crunchbase via email. “The normalisation of remote dealmaking has truncated the fundraising process (at least in the initial stages) and given European founders access to a greater range of investors than ever before.”

Accel is an investor in three of the companies that raised large fundings this past quarter: Celonis, Trade Republic and MessageBird.

The funding pace for European startups has also accelerated. Austria-based online tutoring platform GoStudent raised a $245 million Series C after raising its Series B in March 2021. In our global funding report we noted that Turkey-based Getir, an on-demand delivery service, raised three sequential funding rounds this year so far from Series B through D, totaling $983 million across these three funding rounds.

All told, more than 300 unique European companies have raised late-stage and growth-equity funding in the first half of 2021.

15 JULY 2021

Almost everyone in the industry agrees that Europe is falling short in providing capital to its tech startups, whether at the pre-seed stage or the growth stage. Sure, things are getting better by the day, but we’re nowhere near the levels of capital deployed in regions like the US and China.

It’s not because Europe lacks capital in general. The continent enjoys a relatively high savings rate, and many prominent European families have built immense fortunes through entrepreneurial success and wise investment decisions across several generations. Why doesn’t all this old European money consider innovative local ventures as a potential target?

Even though old-money investors know that they should invest more in tech startups, finding their way to decent returns in the maze that’s the European tech world is not as easy as it sounds.

15 SEPTEMBER 2021

Europe’s unicorn herd has outgrown China’s, following a bumper year of VC investments into the region. Since 1990, Europe has created 296 unicorn companies, worth more than $1bn in total, whereas China’s created a total of 276.

According to new data from Dealroom, Europe has produced 72 new unicorns in 2021 — more than 3x that of China’s 22. Europe is also the fastest-growing region for VC investment globally, having attracted €49bn of investments so far in 2021 — exceeding China, the US and all of Asia.

This means that for the first time since 2016, Europe is ahead of China in the number of unicorns created or $1bn exits — another sign of the enormous momentum in the European tech and entrepreneurial ecosystem.

“European tech has hit a purple patch in 2021,” says Yoram Wijngaarde, founder and CEO of Dealroom. “While records for VC investment are being broken everywhere, no developed ecosystem is growing as fast as Europe. Outproducing China on unicorns is also an important milestone.”

The tech boom is also being spearheaded by European cities; of the 170 ‘unicorn cities’ — cities with one or more unicorns — globally, 65 are in Europe.

Some of the new unicorns created this year include crypto trading platform Bitpanda, digital bank Starling, payments company Saltpay and digital lender Lendable. On-demand grocery delivery startup Gorillas hit a $1bn valuation only nine months after launching.

20 AUGUST 2021

A political initiative that aims to double the number of European unicorns by 2030 launched at the Web Summit today.

The Europe Startup Nations Alliance, which will comprise 27 nations, was established by the Portuguese government with support from the European Commission. The alliance aims to support national governments in improving the structural conditions for domestic startups, to ensure that startups can grow at any stage of their lifecycle.

…

Siza Vieira stated that by increasing access to capital and alleviating barriers to growth, the alliance could double the number of European $1 billion-plus startups in the next 10 years. At the start of the previous decade, European unicorns were virtually non-existent but their count reached 92 in Q2 2021 with a combined value of €253.3 billion, according to PitchBook research. ESNA will also aim to increase the number of startups per capita in Europe.

NOVEMBER 2021

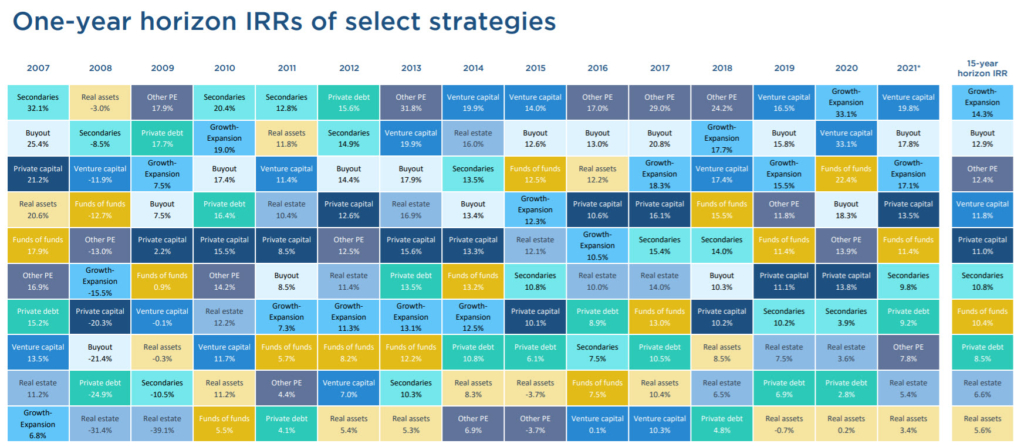

Buyout and growth funds came in second and third—at 17.8% and 17.1%, respectively—before a noticeable drop-off in the results from other strategies.

The trend of VC and private equity standing out in terms of performance has persisted for several years now (see the quilt chart below). This has gained increasing attention across the broader financial landscape as many of America’s largest university endowments have recently reported astronomical gains, boosted heavily by allocations to alternative assets.

OCTOBER 2021

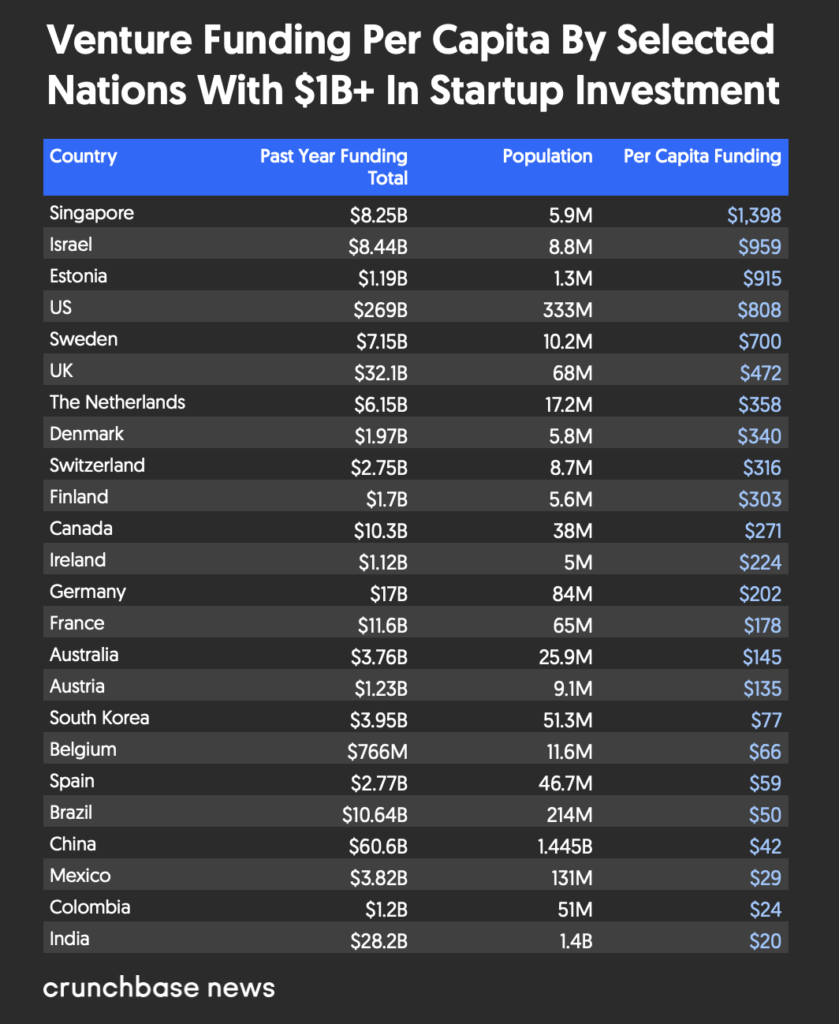

Among the world’s largest nations, the U.S. has by far the highest rate of startup investment relative to population. Over the past year, venture investors put nearly $270 billion to work—averaging out to around $800 for every person in the country.

But among all countries, the U.S. ranks fourth in per capita startup investment. The No. 1 and No. 2 slots go to Singapore and Israel, two smaller countries that punch well above their weight class for tech-driven entrepreneurship.

Among mid-sized countries, meanwhile, the U.K. was the standout, with an investment rate that works out to just under $500 per person.

NOVEMBER 2021